How a website can increase secondary business expenses

Most companies benefit immensely by having a strong online presence. This can include both a website and one or more social media accounts. You may not realize that your online presence could increase secondary businesses expenses, such as liability insurance. Here are a few tips on putting your best foot forward online.

Insurance and other secondary business expenses

Applying for liability and other types of insurance is a pain. There are a bunch of forms, endless questions, and whatever other hoops the insurance provider requires to provide a plan. From the insurance company’s perspective, they want to use everything at their disposal to assess your company’s risk level, which determines the price of the plan. It is not uncommon for insurance companies to look at websites and social media profiles to corroborate or further assess the risk involved with insuring your company.

Website basics

A company website usually covers business basics. It should answer the who, what, where, when, why, and how of your business. Just know that an insurance company may use the information provided to judge your risk.

Therefore, it is important for a business to consider the following when adding to their existing or creating a new website.

A picture is worth a thousand words

Be mindful of the images you’re posting on your website. They should accurately reflect your business, but they should remain professional. Everything that your staff does can be considered in an insurance policy. Think twice before posting the photo of your team’s most recent zip-lining adventure.

Do not post photos of your ID badges on your website. This increases the chance of fraud associated with your business right out of the gate.

Staff Bios

Staff biography or “meet the team” pages can be helpful in building relationships with your clients. But, be aware that an insurance company may use this information to judge the risk involved with insuring your company.

Do not link to personal social media accounts of your staff. Rest assured that the underwriter will take into account the type of people you employ based on their personal social media posts.

Experience

While it is great to include your companies experience, years in business, or big wins, it is important to keep the information on your site current only so far as actual accomplishment. Do not post information about contracts you’re hoping to win, jobs you’d like to take, or experience you may someday have.

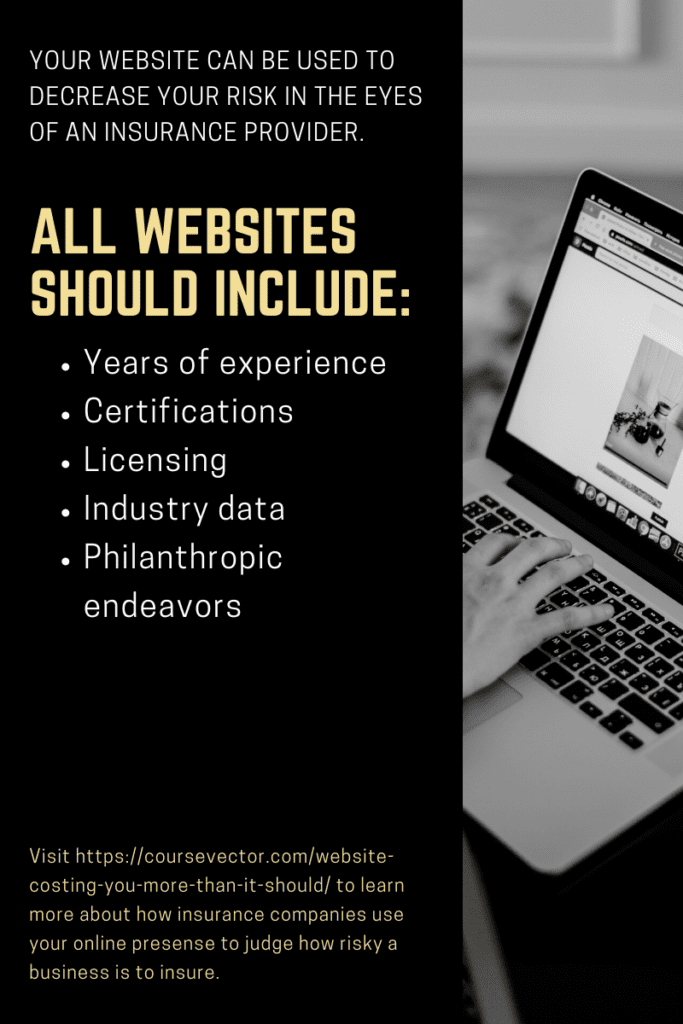

What every website should include

Your website can be used to decrease your associated risk as well. All websites should include:

- Years of experience

- Certifications

- Licensing

- Industry data

- Philanthropic endeavors

Depending on the type of business you are in, it might also be wise to list safety policies and any special technology that sets you apart from the competition.

What to post on social media

Social media should be an extension of your website. It should be just as professional, represent your brand accurately, and serve to further build relationships with your customers. While posts on social media can feel slightly less formal than the information on your website, always make sure that your posts are professional.

Liability insurance is not cyber insurance

General and professional liability insurance can help to protect your business from many accidents. Neither covers data breaches of sensitive information or publishing or media liability. We wanted to make sure to make that distinction since your online presence can increase the cost of both liability AND cyber insurance. Both are necessary if your business collects and stores sensitive information. Both require an insurance adjuster to assess the level of risk your business incurs. But, only cyber insurance covers:

- Replacement/restoration of electronic data

- Website publishing liability/media liability

- Security breach expense and/or liability

- Programming errors and omissions liability

- Cybercrime and/or extortion threats